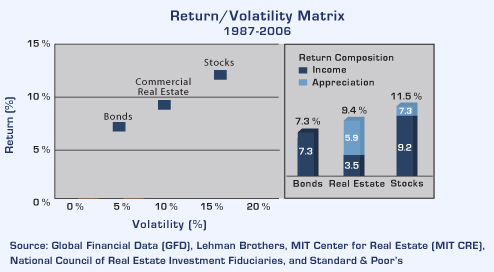

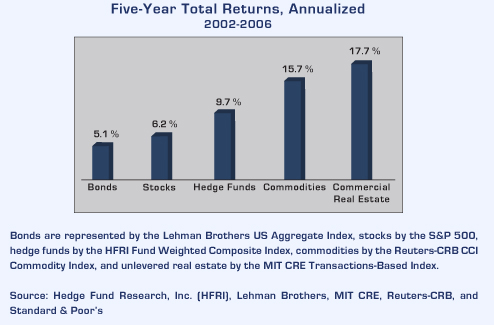

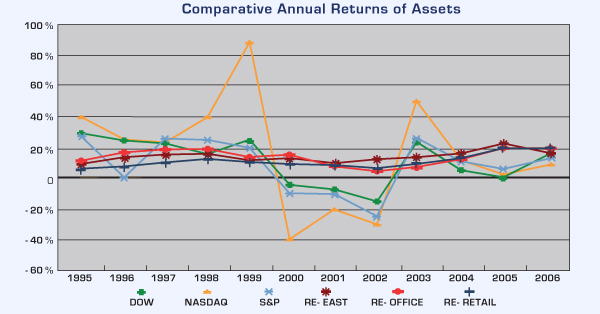

CCGL’s Funds are attractive to investors who desire real estate in their investment allocation for diversification, but have neither the time nor skill to manage those assets themselves. Inherent in such an asset allocation decision is recognition that returns from private real estate investments over time compare quite favorably to the public debt and equity markets and that the markets exhibit a low correlation. Thus, diversification lessens volatility of the overall portfolio and frequently increases yield.

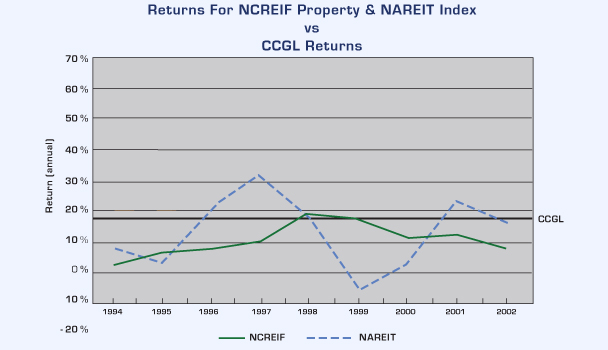

Further, returns on CCGL’s investments have consistently exceeded recognized real estate performance indices. CCGL’s management-intensive, value-added investment strategy has provided over a decade of consistently high investor returns with limited volatility.

CCGL Returns reflect a stabilized return over the entire period, including prior to CCGL’s formation.

By investing in a Fund rather than individual properties, investors obtain diversity of product type, location and time of investment. Further, the Manager’s carried interest is based upon the Fund’s overall return, providing investors protection should an individual asset under-perform. CCGL’s Funds have a lower minimum investment than many other actively managed private real estate funds (which often have a minimum investment of $500,000 to $1,000,000), permitting participation by a broad spectrum of potential investors. CREF IV is a suitable investment for IRA’s and qualified retirement plans. CCGL’s Funds also provide sophisticated estate-planning vehicles for investors who employ family limited partnerships or trusts in their estate plans.